So, the story of the post-dated cheque is that you don’t have sufficient balance on the date the drawee demands the sum from you and you issue him a post-dated cheque with a future date. Similarly, each country has specific rules related to the issue and validity of the post-dated cheque Why is it not advisable to issue a post-dated cheque?

In India, the validity of a post-dated cheque is 3 months from the date mentioned on the cheque. before the payment is due or the service has been completed.

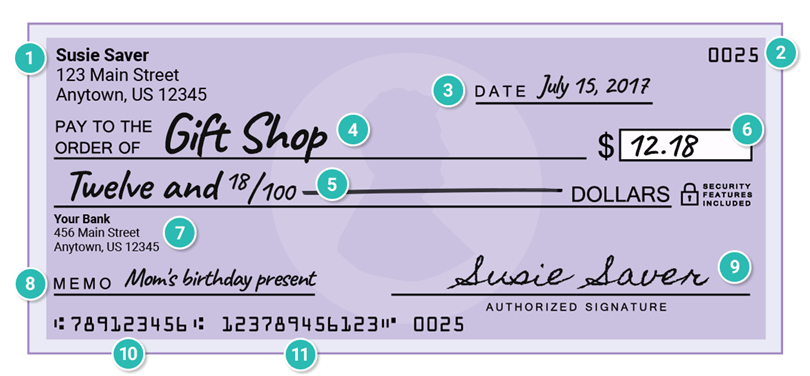

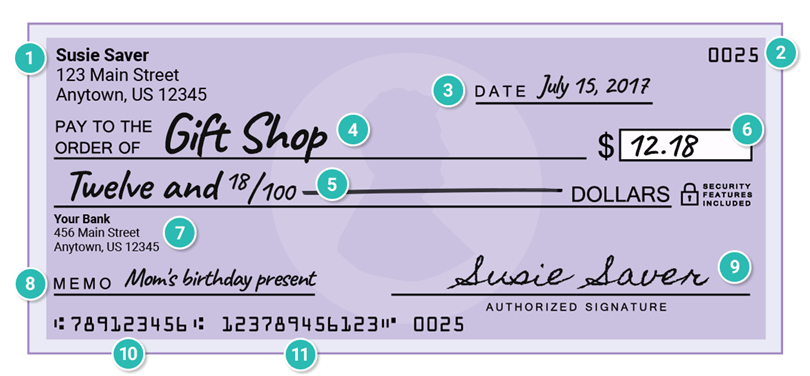

Writing a cheque in advance: A cheque is written for paying something ahead of time i.e. Insufficient funds: You do not have sufficient funds available on the date of writing the cheque, but you are sure funds will be available on the future date or the date mentioned on the cheque. While we know why businesses issue a post-dated cheque, it is also important to know the possible situations under which the post-dated cheque is issued. The gap between 27 th Jan and 3 rd Feb is the wait time here. In the above example, if you are a recipient of the cheque, you can deposit the cheque on 3 rd Feb or after that though the cheque was physically written and received to you on 27 th Jan. If you are a drawer of the cheque and if you have issued a post-dated cheque to the recipient, it implies that a written communication from your end to the recipient asking him to wait for the time, from the date the cheque is physically issued till the date mentioned in the face of the cheque. In writing a post-dated cheque, the only difference is that you will write a future date instead of the current date. Writing the post-dated cheque is no different from writing a regular or normal cheque. Here, it is important to note that cheque will be presented to the bank either on the date written on cheque and after the date. This arrangement of issuing a post-dated cheque to the recipient (the person or business receiving the payment, also known as the payee) is only made when the drawer wants the recipient to wait before depositing the cheque. But when you write a date which is later than the current date, say you write a date of a cheque as 3 rd Feb, this is when it becomes post-dated cheque. Generally, if you write a cheque, you will write the current date of the cheque i.e., 27 th Jan. To simply put, post-dated cheque is one which is drawn with a date which is after the date on which cheque was written.Īssume that today is 27 th Jan and you are writing a cheque. To define post-dated cheque, it is a form of a cheque drawn with a future date written on it. Now we know the definition of cheque, let’s understand post-dated cheque. In simple words, a cheque is a form of a bill of exchange which orders the bank to pay an amount of money from a person’s account to another individual’s or company’s account in whose name the cheque has been issued. It includes the printed form and a cheque in the electronic form. What is a cheque?Ī cheque is a bill of exchange drawn on a specified banker and to be payable on demand. What are the alternatives for post-dated cheque?īefore we understand the definition of post-dated cheque and why it is issued, let’s understand little more about the cheque. Why is it not advisable to issue a post-dated cheque?. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs.

These ads are based on your specific account relationships with us. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.Īlso, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. If you opt out, though, you may still receive generic advertising. If you prefer that we do not use this information, you may opt out of online behavioral advertising.

FILLED OUT CHECK EXAMPLE OFFLINE

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. Relationship-based ads and online behavioral advertising help us do that. We strive to provide you with information about products and services you might find interesting and useful.

0 kommentar(er)

0 kommentar(er)